Inside Intelligence: About Those State Revenue Worries..

/https://static.texastribune.org/media/images/inside_intelligence-logo_1.png)

For this week’s nonscientific survey of insiders in government and politics, we asked about future threats to state revenue collections.

Revenues and budgets are on the minds of lawmakers these days after Speaker Joe Straus' "sober-faced pep talk" and worries about the fiscal implications of multiple lawsuits directed at the state.

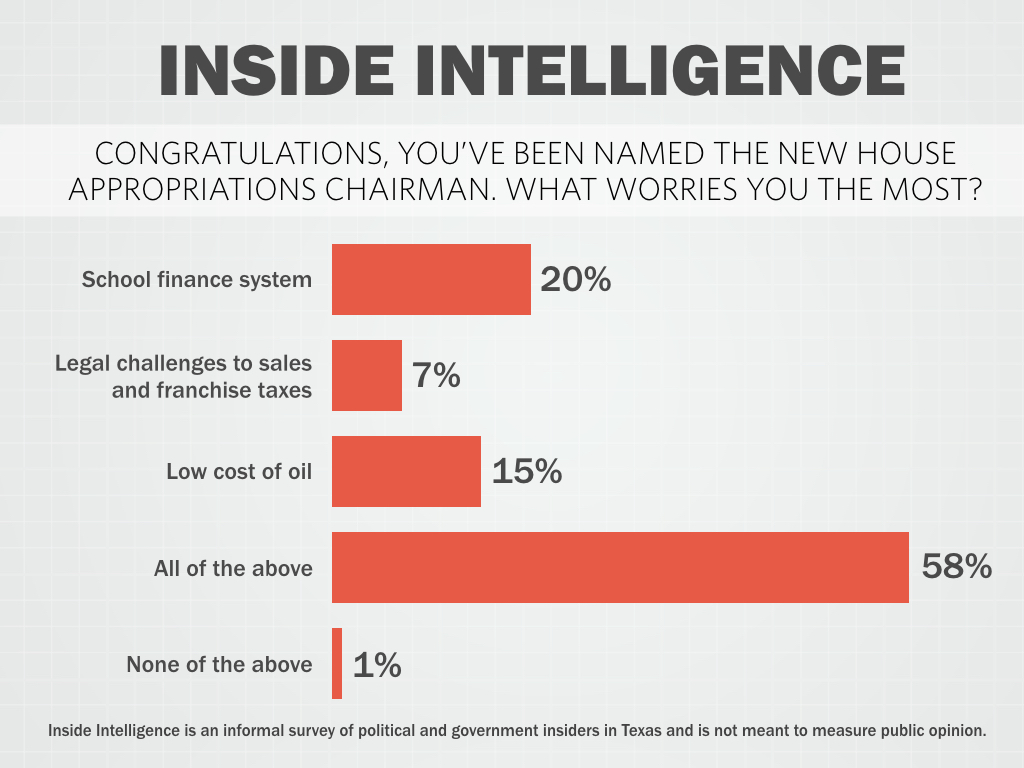

How troubled are those waters? We began this week's inquiry by asking the insiders what should worry most the person who will be tapped to succeed John Otto as the head of House Appropriations.

We listed three things — the school finance system, legal challenges to sales and franchise taxes and the low cost of oil. A solid majority of the insiders said all three things should worry the new chief House budget writer. Another 20 percent cited school finance as the chief worry and 15 percent named the low cost of oil.

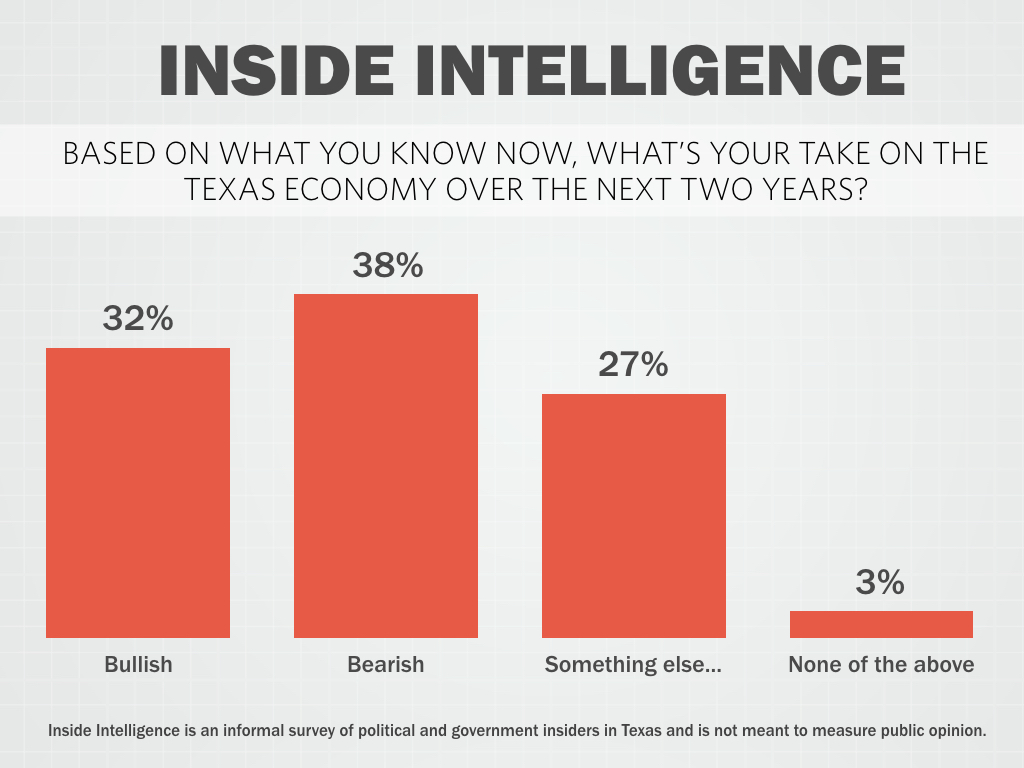

We then asked the insiders for their take on how the Texas economy will perform over the next two years. On this one, the insiders were split for the most part with 38 percent saying they were bearish and 32 percent saying they were bullish.

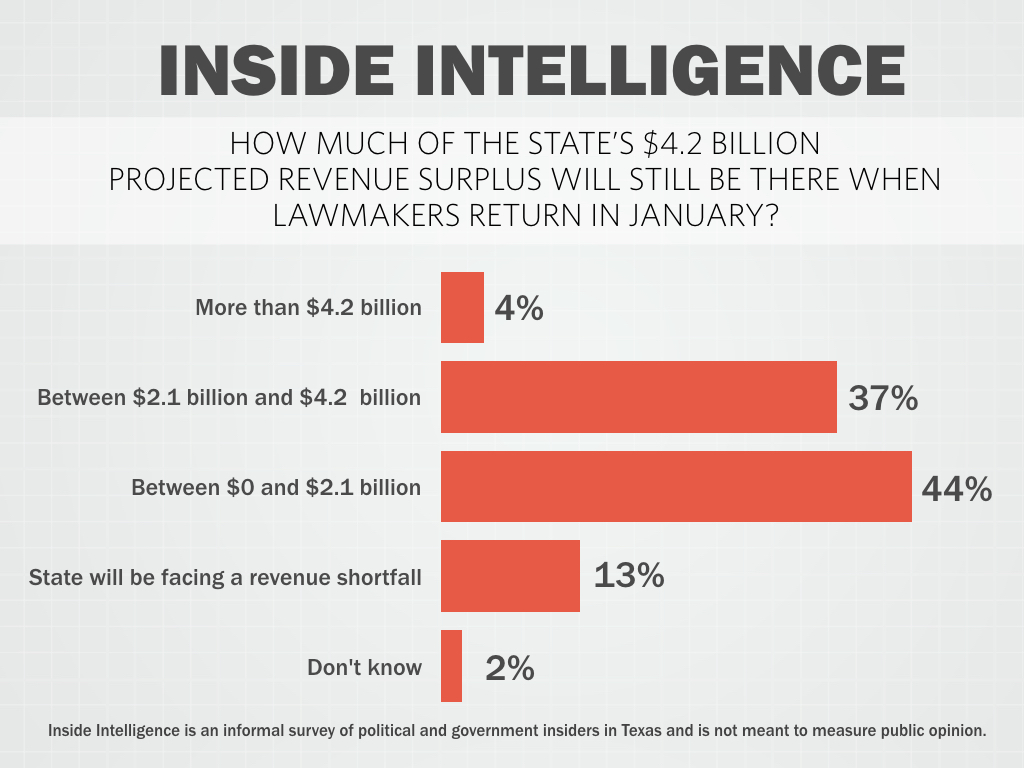

Most thought the state would be able to preserve at least some of the current projected $4.2 billion revenue surplus. A total of 44 percent thought that the projected balance would dwindle to less than $2.1 billion while another 37 percent thought the balance would fall somewhere between $2.1 billion and $4.2 billion.

The insiders were also split on whether lawmakers would use the Rainy Day Fund should the state lose several large tax cases. Exactly 50 percent said they would while 45 percent said they wouldn't.

We collected comments along the way, and a full set of those is attached. Here’s a sampling:

Congratulations, you’ve been named the new House Appropriations chairman. What worries you the most?

• "You only listed revenues. I'm worried most about expenses (like health care and insurance and other things that costs what they cost regardless of the price of oil or sales tax collections)."

• "It's not going to be a fun year on appropriations. But, in classic Joe Straus fashion, the budget process will conclude in an anti-climactic way with a reasonable, generally conservative, but also fairly responsible budget."

• "Oil, while very important, isn't nearly the economic driver it once was thanks to the diversified Texas economy. School finance, on the other hand, has the potential to gum up the budget like nothing else."

• "All of the above, but especially the low cost of oil. Not because oil will stay low; but rather, because the State relies heavily upon a commodity price they cannot control."

• "The person with real worries is the chair of Ways & Means. There's no way out of this without more money."

Based on what you know now, what’s your take on the Texas economy over the next two years?

• "Donald Trump and Hillary Clinton un-inspire economic activity, especially in Texas."

• "WTI is at $41 today, which is about $20 less than a year ago. Hard to see it rising much higher. As oil and gas sputter along, eventually the ripple effects will make their way through the rest of the economy."

• "We will rock along. The state diversified itself in the '80s and '90s. We will be OK."

• "I'm fearing a natural disaster and other problems to be named later!"

• "Oil and gas are much more important to the Texas economy and revenue than many want to believe. The state's economic peaks and valleys still follow the drilling cycle. You'd think we'd be past that by now. But we ain't. If oil and gas stay down, Texas goes down — some."

Based on what you know now, how much of the state’s $4.2 billion projected revenue surplus will still be there when lawmakers return in January?

• "The $4.1 billion 'surplus' in the October CRE includes $3.5 billion in dedicated GR balances, so the next Lege will be lucky to have any 'regular' General Revenue that's not already committed to something. 2016 General Revenue collections will be at least 2 percent short of the Comptroller's most recent forecast. Best case scenario: local property taxes for schools continue rising enough to reduce state aid, freeing up money that's already been appropriated so it can be used for any shortfalls (Medicaid supplemental, natural disasters, etc.)"

• "With zero-based-budgeting, there's no such thing as a budget shortfall. Who says you have to spend everything you spent last year plus population growth! You don't."

• "As much as we like to 'fool' ourselves into thinking we have a diversified Texas economy, we are STILL heavily dependent upon old man oil; his troubles are our budget troubles."

• "The surplus will be there, but the items for the supplemental will quickly erase that amount. The real question is, will the Legislature have the will to draw down the Rainy Day Fund?"

• "It's not really a 'surplus' in the sense of extra money. Just a cash balance, most of which is actually GR-Dedicated funds."

If the state is on the losing end of one or more of several large tax cases, will lawmakers use the Rainy Day Fund to cover the cost?

• "Possibly, if the leadership can't find & agree on enough 'smoke and mirrors'-type budget balancing mechanisms (postponing large payments to 2019; speeding up tax collections; re-amassing GR-dedicated balances). School finance resolution could be postponed to a 2018 special session."

• "They didn't use much of it when the budget cratered in 2011, and if that doesn't tell you something then nothing will."

• "Even though it would only take 16 votes to pass, the Senate won't get 19 votes to take up a bill to spend from the Economic Stabilization Fund."

• "They won't use the Rainy Day Fund directly if they can avoid it. Look for some sleight of hand to make things look more palatable. And also some payback against the industries that brought these lawsuits."

• "Even if Noah was building an ark, they won't touch the fund."

Our thanks to this week's participants: Gene Acuna, Brandon Aghamalian, Brandon Alderete, Clyde Alexander, Jay Arnold, Charles Bailey, Andrew Biar, Allen Blakemore, Tom Blanton, Chris Britton, Raif Calvert, Lydia Camarillo, Kerry Cammack, Elna Christopher, Randy Cubriel, Beth Cubriel, Denise Davis, Eva De Luna-Castro, June Deadrick, Nora Del Bosque, Glenn Deshields, Tom Duffy, David Dunn, Richard Dyer, John Esparza, Dominic Giarratani, Bruce Gibson, Eric Glenn, Kinnan Golemon, Daniel Gonzalez, John Greytok, Clint Hackney, Wayne Hamilton, Bill Hammond, Steve Holzheauser, Kathy Hutto, Deborah Ingersoll, Mark Jones, Robert Kepple, Richard Khouri, Tom Kleinworth, Sandy Kress, Dale Laine, Pete Laney, Dick Lavine, James LeBas, Luke Legate, Ruben Longoria, Vilma Luna, Matt Mackowiak, Jason McElvaney, Steve Minick, Bee Moorhead, Mike Moses, Keats Norfleet, Todd Olsen, Nef Partida, Jerod Patterson, Robert Peeler, Tom Phillips, Wayne Pierce, Allen Place, Gary Polland, Jay Pritchard, Jay Propes, Ted Melina Raab, Patrick Reinhart, David Reynolds, Carl Richie, A.J. Rodriguez, Grant Ruckel, Andy Sansom, Barbara Schlief, Stan Schlueter, Robert Scott, Bruce Scott, Steve Scurlock, Ben Sebree, Ed Small, Martha Smiley, Larry Soward, Dennis Speight, Colin Strother, Sherry Sylvester, Sara Tays, Trey Trainor, Vicki Truitt, Ware Wendell, David White, Darren Whitehurst, Christopher Williston, Peck Young, Angelo Zottarelli.

Information about the authors

Learn about The Texas Tribune’s policies, including our partnership with The Trust Project to increase transparency in news.

/https://static.texastribune.org/media/profiles/John_Reynolds.jpg)