At a Glance: Sizing Up Tax Relief, Lege Productivity

/https://static.texastribune.org/media/images/2015/01/15/PerryFinal453.jpg)

Also getting our attention this week were a couple of size-ups on where lawmakers are on the competing tax relief packages and on comparing legislative productivity between this session and last session.

As has been widely reported, the House and Senate must bridge a philosophical divide on how to parse out tax relief this year. They must decide which is the better option: make the more complicated move to cut a widely reviled tax (i.e., the property tax), or make the simpler move to cut a tax (i.e., the sales tax) that doesn't rouse taxpayers' passions as highly.

The Senate would rather tackle a property tax cut, while the House would rather target the sales tax for a rate reduction.

Both would also make a big cut to the business franchise tax. The net on tax relief is higher on the House side, going strictly by the numbers. Here's how the proposals break down:

*****

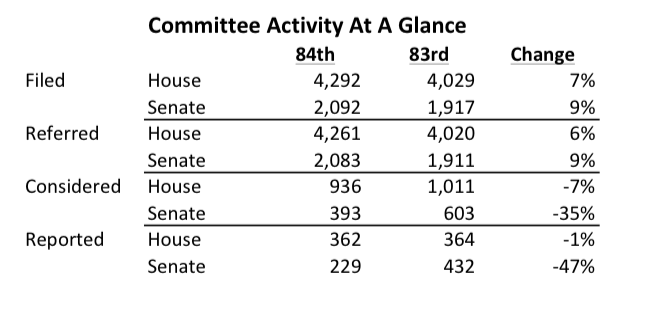

And the folks over at the Professional Advocacy Association of Texas tallied numbers through Sunday on how this Legislature's productivity compares with the last one.

The big takeaway here is that, in both chambers, the number of bills and resolutions filed and referred to committee is up from two years ago by a healthy margin.

However, action on legislation in committee lags, especially on the Senate side.

The amount of legislation considered in Senate committees is down 35 percent, and legislation reported out is down 47 percent.

Information about the authors

Learn about The Texas Tribune’s policies, including our partnership with The Trust Project to increase transparency in news.

/https://static.texastribune.org/media/profiles/John_Reynolds.jpg)